HOW PIND’S MARKET SYSTEMS APPROACH TO DEVELOPMENT PROGRAMMING HELPED FARMERS BUILD RESILIENCE IN THE MIDST OF THE COVID-19 PANDEMIC

PIND complemented by the DFID Market Development (MADE) Program in the Niger Delta (2013- 2020) over the years have worked to build supporting market systems in the region to strengthen private sector-led commercial extension services which was increasing services to the local communities and addressing constraints in access to knowledge, inputs, and output markets in the region. These services were almost non-existent before PIND’s intervention in 2012.

Together both projects reached over 600,000 farmers and small enterprises with over 50% experiencing more than a 30% increase in income between 2012 – 2019. Over this period, both projects introduced solutions that built and strengthened different supporting market systems that poor farmers and enterprises depend on in the Niger Delta. These include the market systems for the provision of commercial extension services, quality inputs, and improved technologies. Over this period the market actors in these systems have matured and changed their approaches to engaging with the poor, treating them as clients rather than as beneficiaries. The level of interconnectedness of the market systems with strong relationships and more appropriate/ specialized services being offered are signs of increasing maturity and resilience.

In February 2020, Nigeria reported its first case of COVID-19 and by March 2020, the Federal Government and many State Governments, including those in the Niger Delta, announced a series of measures to curtail the spread of the pandemic. Although the measures were to curtail the spread of the virus, observations from field monitoring show that it disrupted the economic activities of both the farmers and commercial extension service providers and further worsened the operating environment for market actors in the region. The measures introduced include:

- Total Lockdown with movement restrictions.

- Public Gathering Limitations.

- Inter-State Movement Restrictions.

- Curfews

- Community Restrictions (such as limitation or restrictions of market days)

These measures even though important posed challenges to all Nigerian especially smallholder farmers who needed access to vital inputs such as food, drugs, etc. during the lockdowns and restrictions as a result of the pandemic.

The COVID-19 unique challenges coupled with the fragile operating environment in the Niger Delta region necessitated the need to understand how the external pressures are impacting the market systems that PIND has been supporting over the last eight years and how they are adapting to those pressures to ensure that they can continue providing necessary services to their clients to limit the negative impact of the restrictions on the poor. The stronger relationships between market actors enhanced their ability to adapt, innovate, and respond to the pressures and contribute to the economic recovery of market actors from crises and create more resilient market systems.

This study is therefore intended to assess, report, and present the nature and level of resilience of the PIND strengthened market systems to inform its activities and how it can tailor its support to those market systems, as well as to share the finding with a wider global audience.![]()

DOWNLOAD

FINDINGS AT THE SECTOR LEVEL / VALUE CHAINS

OVERVIEW/METHODOLOGY

To understand the impact of the government restrictions on the aquaculture sector, a rapid assessment was carried out to identify the effects on various market actors in the sector and the adaptive measures engaged by them to overcome the challenges. A total of 26 respondents were interviewed to investigate the impact of the restrictions on their business and the adaptive measures to navigate the challenges. These include fish farmers (9), fish processors (9), service providers (4), and input companies (2). KII was carried out with the respondents using a structured questionnaire.

Impact of COVID-19 on the farmers

Farmers were selected and interviewed randomly across urban, peri-urban, and rural communities respectively. This is to ensure inclusiveness and gain a better understanding of the level of impact vis-a-vis the context of the farmers making sure no one is left behind.

The government action across all levels had a significant impact on farmers despite the travel concession given to agro-dealers. There was a limited flow of inputs, market access, and access to aquaculture services. Also, market access is a major factor as the reduction in demand for fresh and smoked fish resulted in a glut because hotels and other formal markets were shut down during the lockdown. Evening activities such as fish barbeque joints were not operational due to the curfew which further contributed to the reduction in demand for fish. Fish prices dropped during this period due to the low demand, greatly affecting the producers.

Half of the farmers expressed their challenge in accessing finance during the period to procure inputs for production to keep feeding their fish while waiting for the market to pick up again. Financial Institutions were not in operation during the lockdown and loans applied for were not disbursed.

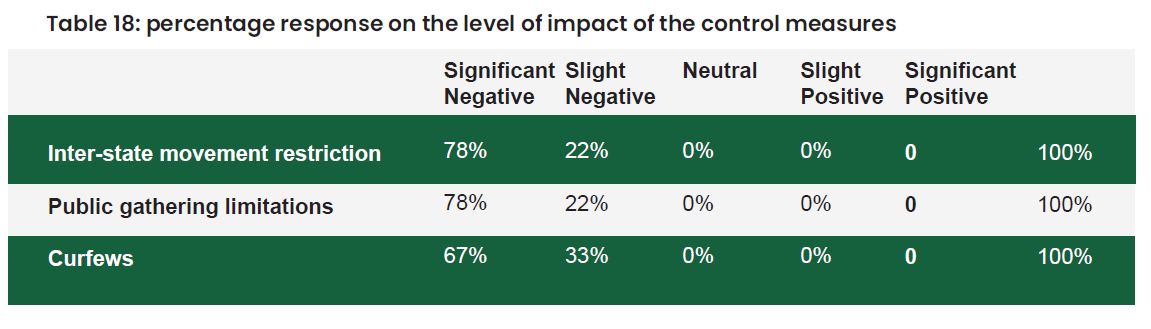

The table 18, shows the distribution of the farmers’ response to the level of impact of the various government control measures on their business. While all farmers were negatively impacted, the movement restrictions and limitation on public gatherings had the greatest negative impact on farmers. The price of fish feed, which accounts for 2/3 of the cost of fish production, increased by an average of about 10% due to the increased cost incurred in importing raw materials by the input companies as a result of the border closure. The increase in the cost of feed contributed to the overall increase in the farmers’ production cost. When added to the reduced demand, it forced many farmers out of business.

![]()

DOWNLOAD

The table below shows that the various control measures had a significant negative effect on the cost of operation and sales of the farmers by 78% and 67% of the respondents respectively.

With the support of the service providers, the farmers gained access to new information that enabled them to identify new clients, access movement pass, and also alternative cheaper feed. The various measures adopted from farmers in response to the pandemic are itemized below:

With the support of the service providers, the farmers gained access to new information that enabled them to identify new clients, access movement pass, and also alternative cheaper feed. The various measures adopted from farmers in response to the pandemic are itemized below:

-

22% of the respondents added value to their fish through the use of processing technology to increase the shelf life and sell at a higher price while one (11%) of the respondents focused on sales of farm produce during the market days;

-

22% of the respondents pooled resources for bulk purchase of raw materials;

- 44% of the respondents made use of phones and other social media to access information and to identify new customers with support from the service provider;

- Increased communication with service providers via phone calls, text messages, WhatsApp, etc by 67% of the farmers.

- In Akwa Ibom state, a cooperative of fish farmers with support from a service provider established a fish market in the state. This enabled farmers to sell directly to consumers through their cooperative. By so doing, they were able to sell at a higher price by eliminating the margin that would have gone to the middlemen, however, the quantity of fish sold per time was smaller compared to selling to wholesalers/retailers.

100% of the respondents tweaked and adapted their business model to navigate the challenges caused by the pandemic and the various movement restrictions imposed by the government. Some of the adaptive measures engaged by the service providers include the following:

The use of technology to increase interactions with clients:

This was done via phone conversations, WhatsApp, Zoom, etc. to provide market information, technical advice, and information on practices to adopt. Half of the service providers (including the input companies) were able to deploy virtual training using online platforms such as WhatsApp and Zoom. WhatsApp was widely used by the service providers.

Leveraging Partnership:

Another mode of adaptation was leveraging on already established local structures to reach farmers. The feed companies leveraged their distribution channels to improve outreach to farmers. They brokered relationships with distributors/agro-dealers to ensure that farmers could pick up the feed at a particular time since most of them were afraid of opening their shops. Some feed companies issued credit notes to some clients. Three of the six service providers leveraged partnerships with other service providers to reach out to farmers with capacity building, technical support, and linkages to inputs and market in locations they could not access.

Introduction of new products and services:

One of the input companies introduced a new brand of fish feed into the market. The feed was developed to meet the needs of the farmers at the time as farmers needed feed that was relatively cheap and also of good quality especially at the finishing stage of production. This enabled the feed company to increase its market share. Other input companies, in collaboration with the distributors and agro-dealers, issued credit notes to some clients to help sustain their production.

Logistics Services:

one service provider, in response to the challenges, introduced a logistics service to facilitate access to inputs for farmers and processors both within and outside the aquaculture sector. He was able to secure the exemption for essential services provided by the government which he used in aggregating demand and moving essential agro produce and inputs such as fish feed to farmers.

OVERVIEW

In the Niger Delta, Cassava is a major agricultural commodity. Understanding the impact of government restrictions on actors in the cassava value chain would shed significant light on the impact of and resilience exhibited by actors in the agricultural sectors in the Niger Delta in the wake of the pandemic.

Before COVID-19 cassava prices had shrunk significantly from their high in 2017 of around N30k/ ton (during the major devaluation), mirroring the cycle of boom and bust driven by the demand and supply dynamics in the sector. When prices are high farmers produce more cassava, leading to oversupply and a fall in prices which in turn leads unincentivized farmers to either pull out or produce less and therefore leading to undersupply and consequent price increases driven by scarcity. As of February 2020, the price of Cassava hovered around 15K-18k/ton, which is a carry-over from the 2018/2019 season of low cassava prices.

With the advent of the pandemic, cassava prices skyrocketed by over 150% moving from around N18,000/ton before the pandemic to between N40,000-N45,000/ton at farm gate and have remained high. This has been attributed to the reduction in imports of other substitute foodstuffs (such as rice) due to the border closings and the increasing demand for cassava products by both the food and industrial market and the relative undersupply of the commodity. During the lockdowns, food prices generally went up and the non-availability of imported food products, including products imported from outside of the Niger Delta further pushed the demand for cassava products. With the border closure, including the closure of the ports, the industrial sector also deepened their search for local inputs including Cassava to replace food and industrial products (like starch and glucose). All these on the back of mass production of food products like Indomie noodles, spaghetti, rice, garri, etc. which were distributed out as palliatives and most of which require Cassava as an input5. The lockdown instituted by the government in April came as a shock to small-holder farmers in the Niger Delta. The fact that movement restrictions were indiscriminately implemented by security operatives also meant that many farmers could not easily get to their farms. Farmers’ access to services and markets was also severely disrupted.

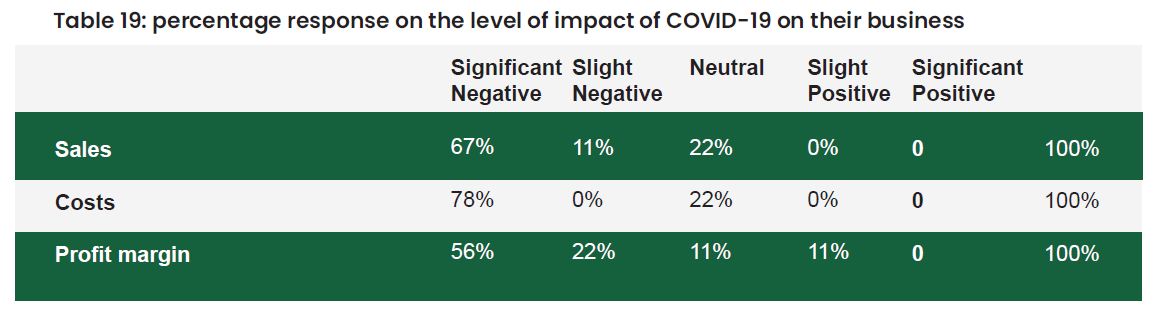

To analyze the impact of COVID-19 on the sector, three sets of respondents were interviewed to better understand how the pandemic may or may not have affected their businesses and to determine adaptive measures adopted to overcome the challenges. This was done using structured questionnaires. A total of 18 respondents were reached virtually consisting of Agro input companies, agro-dealers/Farm service providers (FSPs), and Cassava farmers.

Impact on cassava farmers

The nine interviewed cassava farmers were selected from among farmers who had participated in the PIND cassava intervention across the following states Edo, Delta, Abia, Imo, Bayelsa, Cross River, and Akwa Ibom, to determine the impact of the pandemic and the market actors’ responses. The respondents included five females and four males.

![]()

DOWNLOAD

- The government restrictions negatively affected all the respondents. They occurred during the main cassava planting season in the Niger Delta. Table xx, below, captures the range of responses from the farmers. The initial lockdown had a significantly negative impact on the business of 78% of farmers and slightly negative on 22% of farmers in the areas of being unable to access inputs due to intra and interstate movement restrictions, thereby preventing access to inputs, and increased costs of inputs. Farmers faced difficulties sourcing for inputs and other services, and transportation of agro products became impossible; with the markets locked up, there was difficulty buying or selling agro products.

- The public gathering limitations had a significant negative impact on 89% of the respondents with the remaining 11% slight negative impact, as the social distance policy prevented face to face contacts to receive agricultural information, training and demonstration activities, and equally prevented movement and travel necessary for the purchase of inputs. This limited information sharing by service providers. This policy also limited sales of produce because the markets were locked.

- The curfews reduced the time spent on the farm because farmers had to go late and return early to obey the rules, this also necessitated increased cost of transportation for farmers who could move, especially because this was the typical planting season for Cassava. 56% of the farmers reported a significant negative impact while 22 % reported a slightly negative impact. However, 22% of the respondents also reported a neutral impact as they were able to navigate their activities within the timeframe of the curfew. 56% of the respondents reported a significant negative impact since after the lockdown mainly with regards to the increased cost of inputs.

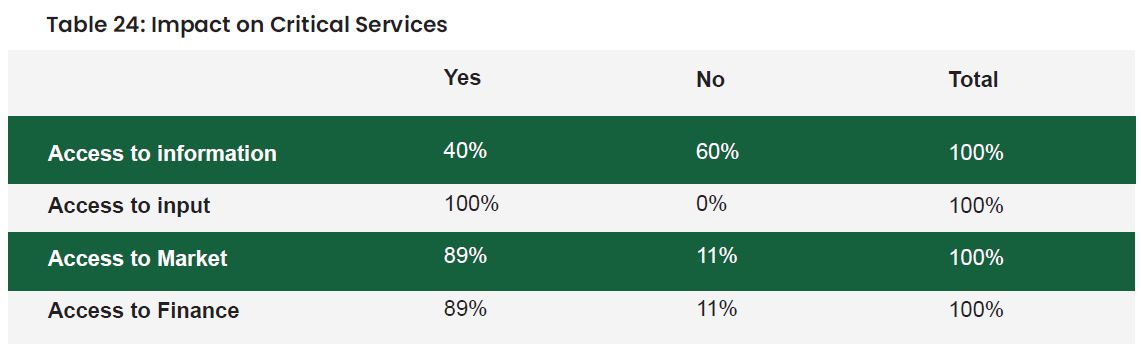

- Farmers also reported lower negative effects on their access to information. Only 40% felt negatively affected, while 60% not. Those farmers who responded no to the question confirmed that despite the pandemic they relied on the use of telephone to reach service providers for training and support; social media and neighborhood friends were also sources of information.

- Not surprisingly all respondents reported a negative impact on their access to inputs, as the prices spiked and were sometimes difficult to access due to the lockdown and restrictions. 89 % were negatively affected by access to markets. This was mainly due to the closure of markets and reduced number of off-takers due to the restriction of movement. 89% of the farmers were also negatively impacted with regards to access to finance as most of the banks were shut and the covid19 protocol in place limited easy access to the few open branches. Lenders were also reluctant to provide financial services due to the perceived high risk occasioned by the prevalent uncertainties.

- Community control measures included canceling of market days, controlling the number of sellers on the market days and this affected the cassava farmers business with limited buying and selling, with no place to sell harvested farm produce, no display products to market, hence no buyers/off-takers, thereby heavily limiting patronage. Farmers also had challenges accessing enough labor for land preparation.

- The cassava farmers’ response to overcome the restrictions included utilizing more family labor for cultivation. Farmers also resorted to the use of organic manure in the absence of fertilizer at the time; hoping that the situation was temporary.

- Some of the cassava farmers utilized deepened relationship through making a call to agro-dealers to waybill products, with the high cost of way billing, farmers would aggregate their requirements and have the lead farmer demand the products, make payments through transfer, and call the agro-dealers for guidance and consultations when necessary.

44 % of the respondents consider access to finance as the first challenge and second challenge. 44% of the respondents found access to input as their first challenge while 22% identified this as their second challenge. This is irrespective of the specific challenge identified as 1st and 2nd by the respondents.

Only 11% of the respondents identified access to technical services as their first and second challenge. 33 % of the respondents indicated that service providers were able to help them address the challenges, while 67% responded otherwise.

Further analysis of the data however shows that all the respondents who identified access to technical services as their challenge also answer yes to the question on whether service providers were able to help them address those challenges. Service providers helped to address the challenges through engagement on the phone, to respond to questions from farmers, and to guide on basic practices

but they rarely provided inputs, only occasionally when many farmers placed demands for certain products which were delivered by waybill after some delay.

OVERVIEW

The palm oil value chain is comprised of farmers and processors, supported by a number of agro-dealers, millers, fabricators, and farm service providers. The farmer owns or rents the farm that produces fresh fruit bunches (FFB) while the processor buys FFB from the farmer which is processed to extract palm oil for onward sale in the end market. In most cases, processors also own their farms, and depending on the production scale of the processor, they purchase additional FFB from other farmers to process.

The processors are supported by millers who charge them a fee to use their processing machine; although, some processors own their processing machine. Fabricators manufacture and service the processing machines for the miller. The farmers rely on agro-dealers to provide information on best management practices and inputs (fertilizer, herbicides) for their farms which improve their yields. They also rely on farm service providers who vary in the roles they play; some are micro-retailers of inputs (seedlings, fertilizer) or laborers or provide advisory support. Other service providers include the equipment sellers that sell technology for harvesting and farm maintenance.

Methodology

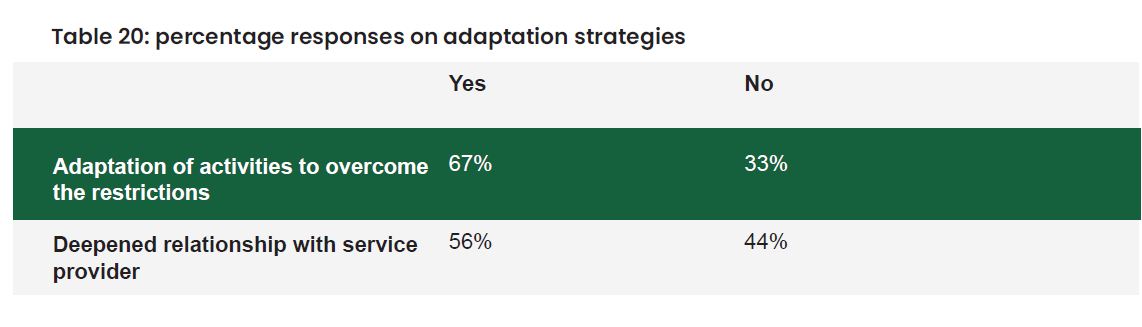

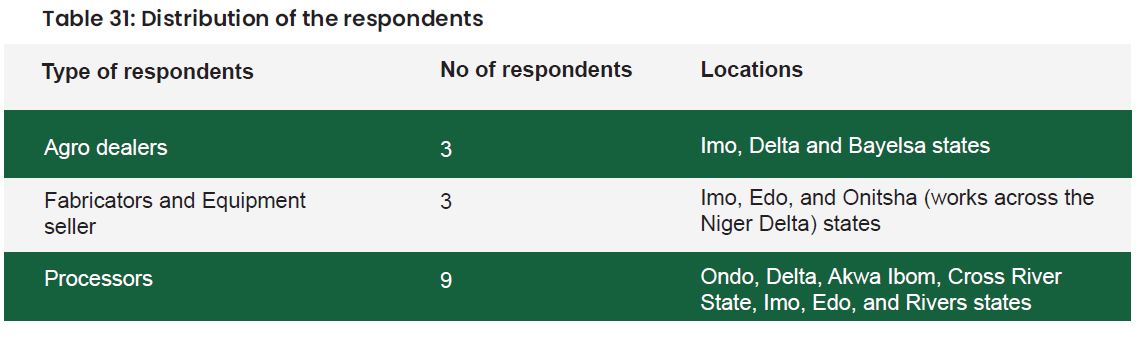

The assessment was carried out on three sets of respondents. They include agro-dealers, fabricators, an equipment seller, and processors. Key Informant Interviews (KIIs) were done with 15 randomly selected respondents using a semi-structured questionnaire. The assessment was done virtually via phone. The geographical spread of the respondents is presented in the table below:

![]()

DOWNLOAD

Impact of COVID-19 on the Palm Oil Processors

One of the key areas investigated was the effect of the pandemic on the processors’ access to critical services and their performance.

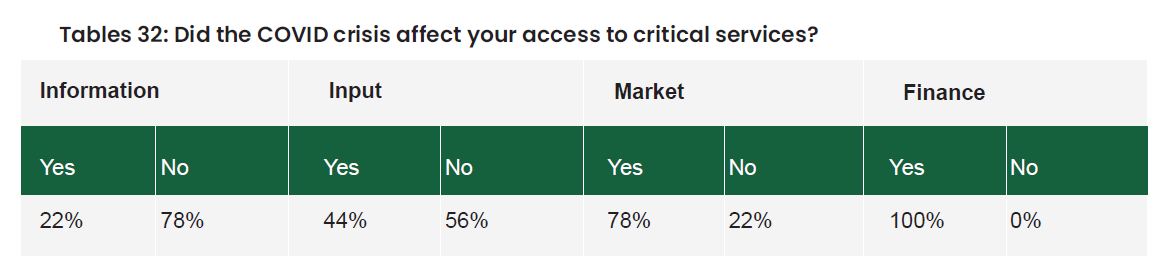

The table above shows that government restrictions mainly affected the processors’ access to markets and finance. The curb on public gathering led to regulation of main market activities which affected 78% of the processor. The main markets were closed thus processors had to sell in makeshift local markets within their communities. Although palm oil was an essential good, it was challenging for the processors to deliver the product to off-takers and big traders within and outside of the state due to the high cost of transportation and difficulty in getting a pass. This caused a drop in the price10 of palm oil during the period11. In terms of access to finance, all the processors were affected stating that the drop in the price of palm oil limited their cash flow, there was difficulty getting money from the banks due to the covid-19 guidelines and there wasn’t support from the government.

Meanwhile, 78% of the processors stated that the restrictions did not affect their access to information and inputs such as fresh fruit bunches. The processors received advisory support and market price information from service providers through phone calls. For one processor, the off-taker ordered for palm oil through phone calls. The 22% of processors that lacked access to information required information on loan and market opportunities. Concerning inputs, 56% of the processors stated that they had fresh fruit bunches readily available to process while 44% found it challenging due to the movement restrictions. The processors that did not have a challenge with FFB lived close to farm clusters.From the analysis conducted, 100 Percent of the processors adapted their activities to overcome the restriction while 67% of the processors own their processing machine. Some of the measures include:

- 67% of the small processors relocated from township to the rural area to increase ease of accessing FFB for processing and local markets to sell their palm oil;

- 33% of the medium processors did not take their palm oil to the makeshift local market but sold directly from their storage facility at a regulated price; and

- 67% of the large processors stored their palm oil until the lockdown was eased, the price increased, and the regular distribution channels opened.

Impact of COVID-19 on farmers and adaptive measures

100% of the processors interviewed also play the role of farmers. During the investigation, it was evident that farming activities mainly were affected by movement restrictions. For example, the price of fertilizer increased by 36%-43%13 due to the increase in transportation. The farmers adapted by purchasing a low quantity of fertilizer and complemented it with the use of organic fertilizer (empty fresh fruit bunches). Also due to movement restrictions, farm service providers (laborers that maintain their farm) were unavailable. 44% of the farmers adapted by providing additional Incentives (palliative care) to the FSPs during the period.

67% of the agro-dealers provided advisory support and information about the availability of inputs through phone calls;

67% agro-dealers strengthened relationships with other Farm service Providers and small agro-dealers across different communities to support the sales of inputs including seedlings;

33% of the agro-dealers carried out 1-on-1 engagement with farmers/processors on their farms during the lockdown, and when the restrictions were eased, 67% of the agro-dealers commenced physical demonstrations and training to a limited number of farmers following the Covid guidelines; and

50% of the fabricators mentioned that on request, they provided physical maintenance for his client while the other stated that none of the clients required servicing during the period.

OVERVIEW

The cocoa value chain is comprised of farmers, aggregators, and exporters. The farmers are mainly supported by the agro-input suppliers and the farm service providers who provide quality information, inputs, and technologies that the farmers require for improved productivity. The restrictions enacted by the government to curb the spread of the coronavirus had a slight adverse effect on the farmers in accessing inputs and labor necessary for their activities; as well as the farm service providers and input suppliers. Most of the inputs required by farmers, which include crop protection products (fungicide, pesticide, herbicide, and fertilizers) and also technologies for the pruning of the trees, spraying of crop protection products (CPPs), and weeding are supplied by the input companies, agro-dealers and technology promoters. The productivity of cocoa farmers depends on the appropriate and efficient use of these CPPs and technologies in their farm, so the farm service providers support the farmers in training them on how best to use the products and also offer technology services to them.

As a result of the pandemic, the input companies and technology companies found it difficult to move these products to the farmers through the agro-dealers. This increased the logistics cost and transactional cost in reaching farmers which led to scarcity and increases in the cost of these products. Another important input for the farmers is labor and with the reduced movement of people, labor became scarce.

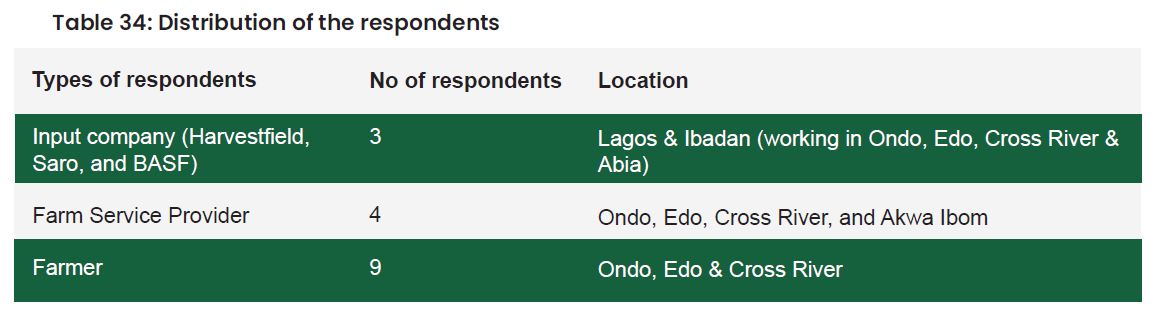

Methodology

The study was carried out on three sets of respondents (input suppliers, Farm Service Providers (FSPs), and farmers) to investigate the impact of the restrictions on their activities/businesses and the adaptive measures employed to ensure that they remain in business. Key Informant Interviews (KIIs) were done with 16 randomly selected respondents (three input companies, four farm service providers, and nine cocoa farmers) using a semi-structured questionnaire. The assessment was done virtually via phone conversations. The geographical spread of the respondents is presented in the table below:

![]()

DOWNLOAD

Impact on the cocoa farmers

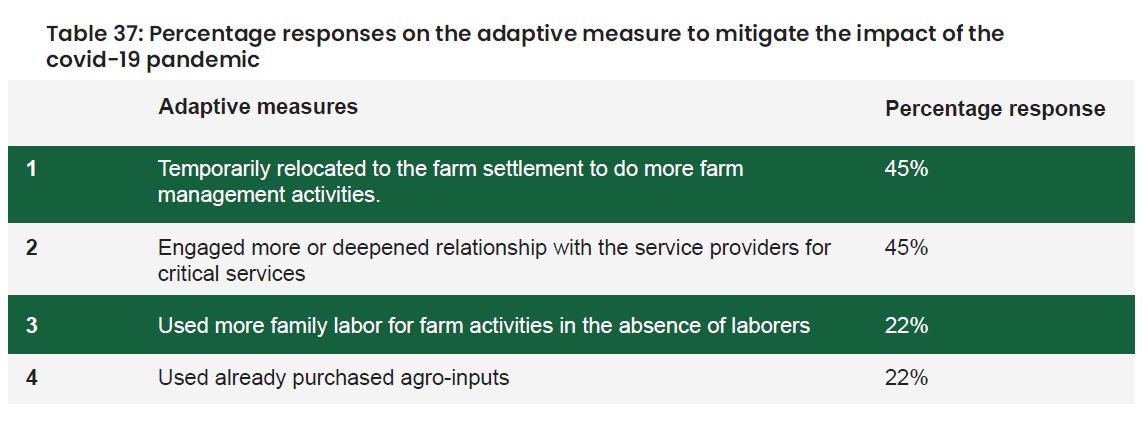

The overall impact of the pandemic on the farmers was found to be positive. Overall, the price of cocoa beans went up by 17% due to a 6% drop in international supply. The cost of inputs increased due to logistics costs of getting inputs to the farmers. However, the period of the restrictions allowed many farmers to do more work on their farms, with some farmers temporarily relocating to the farm settlements. So overall, farmers spent more time on production and the benefits from the increase in prices of cocoa beans exceeded the slight increase in the costs of production.

The main negative effects were due to public gathering limitations, with two-thirds of the farmers citing a significant or slightly negative impact. Otherwise, the farmers were primarily neutral on the impact to travel restrictions, while those who relocated to their farms because of the curfew felt it had a slight positive impact.

- The majority of the farmers interviewed (67%) claimed that they had difficulty accessing inputs from the open market due to the controls on market and market days. There was also a scarcity of labor for farm activities due to the restriction in movement and public gatherings. However, 87% of the farmers said they received support from the farm service providers in form of information, inputs, and labor (pruning, spraying, and weed management) services.

- All of the farmers claimed a neutral effect on their businesses as regards access to information, market, and finance. 89% of the respondents affirmed that they received farm information from service providers via virtual means (phone calls and SMS). The period of the pandemic was not the main season for harvest and sales of cocoa beans, so the closure of markets did not affect sales of cocoa beans. Information was available to the farmers through the FSPs.

- Major challenges faced by the farmers during the pandemic were the high cost of inputs and labor services. This increased cost of both inputs and labor resulted in higher costs of production by between 5% – 8%. The price of cocoa beans also increased (a 17% increase) which helped to cushion the effect of the increase in the cost of production. From the responses from farmers as shown in the table below, it seems to suggest that even though 67% of the respondents had a negative effect on their business as a result of the increase in the cost of production, the overall impact on profit margin was either neutral (67%) or slightly positive (33%).

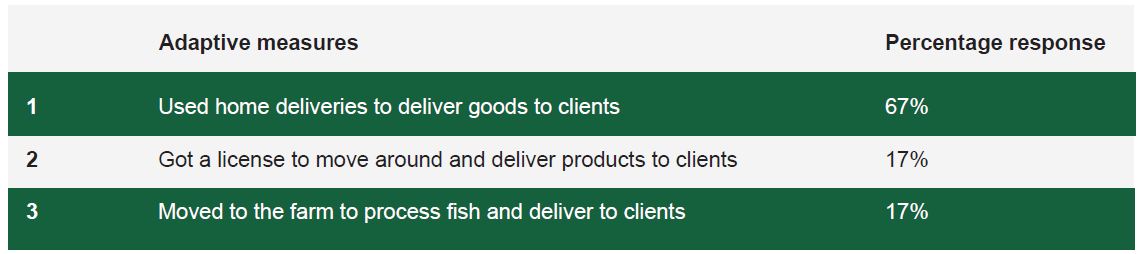

Adaptive measure by FSP in response to Covid-19 restrictions

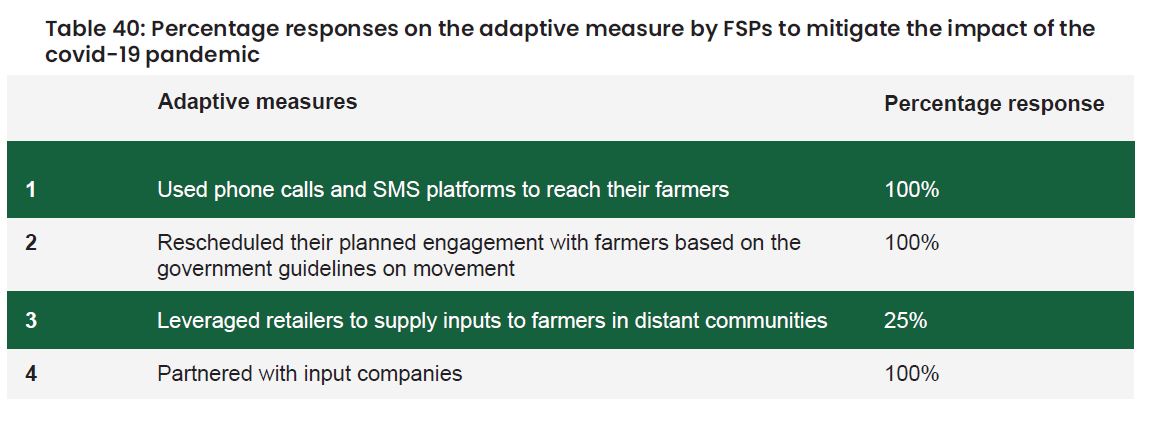

All of the respondents said they adapted their services in the light of covid-19 to be able to reach their clients (farmers). The table below presents the different adaptation measures employed by the FSPS in light of Covid-19.

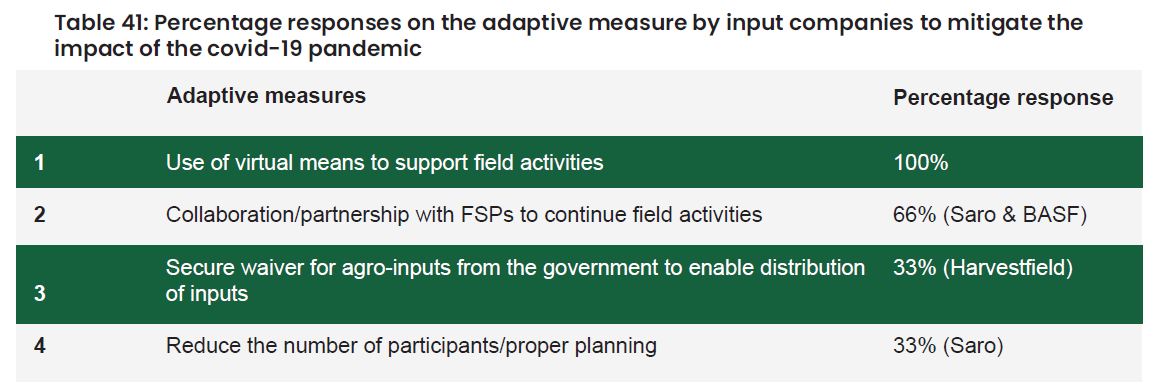

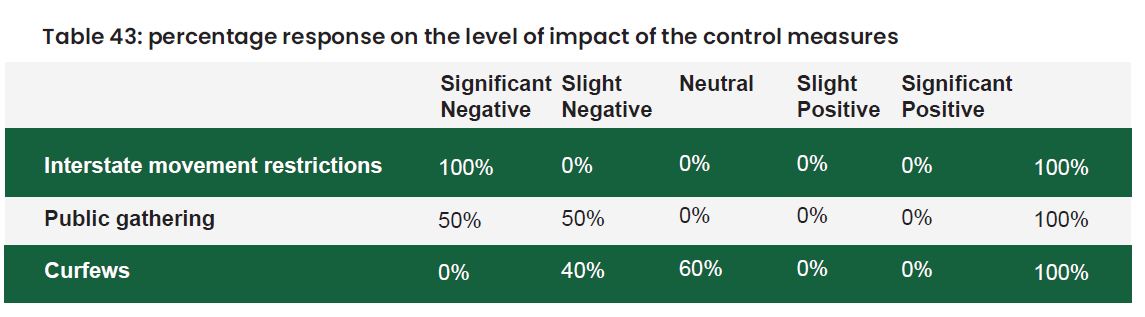

Three input companies were selected and interviewed. These are Harvestfield Industries Limited, Saro AgroSciences Limited, and BASF. Their businesses were impacted negatively by the covid-19 pandemic with 100% of the respondents saying that the control measures by the Government had a slightly negative impact. There were disruptions in promotional activities, inability to move products to distributors, agro-dealers, and retailers increased cost of imported products (most of the products are imported) and increased cost of transportation and haulage.

Three input companies were selected and interviewed. These are Harvestfield Industries Limited, Saro AgroSciences Limited, and BASF. Their businesses were impacted negatively by the covid-19 pandemic with 100% of the respondents saying that the control measures by the Government had a slightly negative impact. There were disruptions in promotional activities, inability to move products to distributors, agro-dealers, and retailers increased cost of imported products (most of the products are imported) and increased cost of transportation and haulage.

Harvestfield and Saro said that market controls or market cancellations had a negative impact on their businesses. Farmers could not go to markets to buy their products which led to a drop in sales. The closure of banks also restricted banking transactions. The lockdowns and curfews did not allow them to move their stock to meet the demand from their clients. BASF did not experience these impacts because they only wholesale and rely on companies like Harvestfield and Jubailli to get the product to the farmers.

Adaptive measures in response to covid-19 restrictions 100% of the respondents said they had to adapt their strategies to be able to deepen the relationship with farmers, promote their products, and improve sales.

Saro AgroSciences and BASF continued field activities amidst the pandemic, working with trained Farm Service Providers

in the Niger Delta as shown in the table below.

These adaptive measures ensured that Saro and BASF enhanced their presence in the Niger Delta, reached more farmers, and are experienced increased sales, especially for Saro who sells their products directly.

OVERVIEW

The poultry value chain comprises different categories of farmers involved in the production of birds and eggs. The actors are supported by several poultry service providers, processors, input companies, and Village Level Dealers (VLDs) whose services/ products are essential for the optimal performance of the farmers. The government restrictions enacted to address the COVID-19 pandemic created significant adverse impacts on the poor and marginal poultry farmers for growing, saving, and selling their products but also to the poultry service providers and input companies. The poultry sector uses inputs that come from around the country, including day-old chicks, feed, and veterinary inputs. Poultry farmers’ profitability is dependent on good production practices and the effective utilization of inputs, especially feed and vaccines, so service providers invest time and energy in building the knowledge of the farmers.

Since many of the inputs for the production of poultry feed are largely imported (maize and soya), the border closures affected the supply of feed leading to increases in prices at the national level. The increase in the prices of the feed also led to an increase in the prices of chicken and eggs at the local markets in the Niger Delta.

Methodology

This study was conducted on three sets of respondents (poultry farmers, service providers, and input companies) to investigate the impact of the restrictions on their businesses and the adaptive measures employed to ensure that they remain in business. Key informant interviews (KII) were carried out with the respondents using structured questionnaires. The assessment was done virtually through phone conversation. A total of 14 respondents were interviewed consisting of 10 poultry farmers, 3 service providers, and 1 input company.

Ten poultry farmers and three service providers were selected from across Imo, Delta, Abia, and Rivers states. The input company (Zygosis Nigeria Limited) is based in Ibadan and supplies vaccines and drugs into the Niger Delta region.

![]()

DOWNLOAD

- The government restrictions affected farmers’ access to essential inputs, markets, support services, and finance. The restrictions hindered the free movement of essential inputs such as day-old chicks (DOCs), feed, drugs, and vaccines from the input companies to the farmers. Increases in the cost of transportation and scarcity led to hikes in the price of inputs. The feed price went up and supply dropped drastically. The total closure of the Nigeria border also led to a scarcity of raw materials such as maize and soya beans required for the production of feeds. All of the farmers interviewed were significantly affected. The price of feed went up by 7%-10% while the price of DOCs doubled.

- The ban on social gatherings and the closure of fast-food restaurants reduced demand for poultry products. Occasions such as weddings, birthdays, and other social events and ceremonies could not be held. Birthdays and weddings are normally associated with cakes, which has eggs as one of their important ingredients. Chickens are mostly used as protein for refreshments during these ceremonies. Reduction in these gatherings reduced the demand for eggs and chicken.

- The responses from the survey show that 75% of the farmers had challenges accessing finance during the lockdown. Financial Institutions were not in operation and loans were not disbursed. However, 25% of the farmers interviewed were able to access the CBN AGSMIES and COVID 19 loans through their service providers.

- The ban on social gatherings also affected the business of the service providers as well as the input companies as service providers could not hold physical training on best poultry services for farmers.

- The curfew only had a slightly negative effect on some poultry farmers, as most of their activities are done during the day, though 40% of the farmers claimed it affected their sales as some customers had less time to shop.

Farmers adopted the following measures during the pandemic

- 33% of the farmers resorted to the use of social media platforms to advertise and sell their produce.

- 50% of the farmers targeted the market days to sell their produce and others took advantage of the periods the restrictions were eased.

- 25% started direct sales around their neighborhood to advertise and sold their produce.

- 75% of farmers leveraged service providers to access inputs from the input companies.

- 100% of farmers reported increased communication with service providers via phone calls, text

messages, etc.

All four service providers including the input company interviewed revealed that their businesses were impacted by the precautionary measures imposed by the government to help curtail the spread of the deadly disease. Input dealers could not get their products across to their customers. Products were stuck on the highways. Field staff of input companies and service providers could not move around freely to deliver their services as they had done before the outbreak of the pandemic.

The curfew imposed had the least impact on the farmers and mainly affected the feed companies who usually move inputs at night. It also disrupted production during their night shifts.

- All of the service providers tweaked their approach and adapted their business models to enable them to overcome the challenges caused by the various restrictions imposed by the government. The input company (Zygosis Nigeria Limited) and one of the service providers (Chuuvak Agro Services) interviewed said they took advantage of the waivers for free movement of agro products. This is to enable actors in the agricultural space to move freely and carry out their business activities.

- During the lockdown period, the exemption of actors in the agricultural sectors from the restrictions afforded service providers the opportunity to deliver products such as vaccines, feeds, and DOCs to the farmers on their farms for a fee. Others resorted to the use of technologies to increase interactions with their clients and reduced their visits to the field. All service providers interviewed used social media platforms such as WhatsApp, Zoom, Facebook, and phone calls to reach out to their clients.

- They also organized training programs for not more than 20 farmers at a time. Input companies relied more on phone calls to reach clients and couriered inputs to customers in dire need of inputs which increased the cost of the inputs to farmers.

- All of the respondents collaborated with other service providers in the region to reach clients in

locations where they could not reach as a result of the restrictions.

New Business Opportunities and positive impact

None of the service providers benefitted from the various government stimulus package offerings, such as the COVID 19 loan, NAFDAC registration, palliatives, etc. However, half of them provided their clients with information on how to access the stimulus packages to reduce the impact on their businesses. They provided information on various loan schemes such as the CBN COVID 19 loan and Agri-Business/Small and Medium Enterprise Investment Scheme (AGSMEIS). They also provided online training to farmers on how to access the loans.

Market and client base

75% of the respondents (service providers) experienced an increase in their client base. However, it did not translate to an increase in income for a few of them. This is because farmers had less money to spend on services. The remaining 25% (input company) of the respondents did not experience a decrease or increase in their client base but saw an increase in the demand for their products which they could not meet due to the restriction of movements.

OVERVIEW

The measures enacted by Government at different levels have had a severe impact on the Micro, Small, and Medium Enterprise (MSME) landscape in the Niger Delta. Activities in the sector are being driven by Business Service Providers who work in partnership with financial institutions, large corporate buyers, chambers of commerce, and other public and private stakeholders to provide the support necessary for the development of the MSMEs. The MSMEs include those in production, processing, marketing, construction/fabrication, manufacturing, catering/confectionaries, fashion, entertainment, and other forms of businesses. The inputs and raw materials required by the MSMEs are either imported or sourced from a varied range of sources that cut across different sectors. They also required technical and business development support to improve their business performance and become competitive within their respective industries. These supports are majorly provided by business service providers who invest their time in diagnosing and implementing upgrading plans and strategies for the MSMEs, facilitate linkages to finance to access funds needed for growth and market opportunities for the MSMEs to sell their produce.

As a result of the pandemic, most of the businesses were closed down for a period of three to five months due to the restrictions in movement and public gatherings. Also, the cost of inputs and raw materials increased significantly, market access to buy and sell reduced, there was general low patronage and also access to information and business support services were limited.

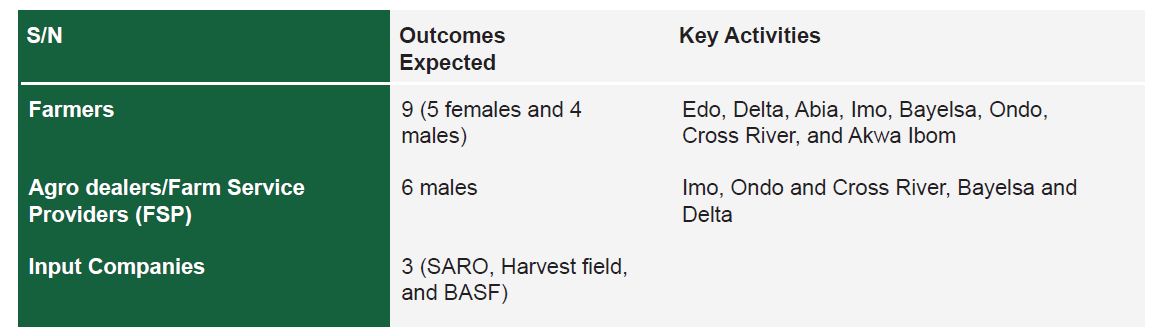

Methodology

Two sets of respondents were interviewed (Business Service Providers (BSPs), and MSMEs to investigate the impact of the restrictions on their activities/businesses and the adaptive measures employed to ensure that they remain in business. Key Informant Interviews (KIIs) were conducted with nine randomly selected respondents using a semi-structured questionnaire. The study was done virtually via phone conversations. The geographical spread of the respondents are presented in the table below:

![]()

DOWNLOAD

To enhance PIND’s reputation and influence with key stakeholders on policies, practices and investments that help reduce conflict and poverty in the Niger Delta and contribute to achieving financial sustainability, while also managing PIND’s internal communications needs.

- The overall impact of the pandemic on MSMEs was significantly negative. There was limited flow (scarcity) of inputs/raw materials, high cost of raw materials/inputs, high cost of transportation, scarcity of labor, poor market access to sell products, difficulty in receiving orders and specifications from clients, and general poor patronage. A breakdown of how government restrictions affected the enterprises is presented in the table below:

- Access to critical services was also impacted by the covid-19 crises. All of the respondents faced poor access to inputs, 67% of the respondents had issues with market for their products and 67% had disrupted access to finance for their businesses. Low demand for products led to very poor sales for an average period of five months due to the lockdowns and restrictions on gatherings and events.

- Those who produce perishable goods were particularly severely impacted and resorted to selling to their neighbors or clients within their vicinity. Those in the manufacturing or construction businesses could not import raw materials from outside the country and so had to suspend operations.

- All these factors had a significant negative impact on the cost of production, sales, and profitability. To put this in perspective, most of the businesses could not record profit for five months. Table 47 below presents an overview of the impact of the pandemic on businesses in terms of sales, cost of production, and profit margin.

A greater proportion of the MSMEs interviewed (67%) were able to adapt their strategies to at least continue in business. The remaining 33% of the MSMEs interviewed were those in the manufacturing or construction industries who could not open their workshops within the periods of the lockdowns. The table below highlights some of the adaptive measures by businesses.

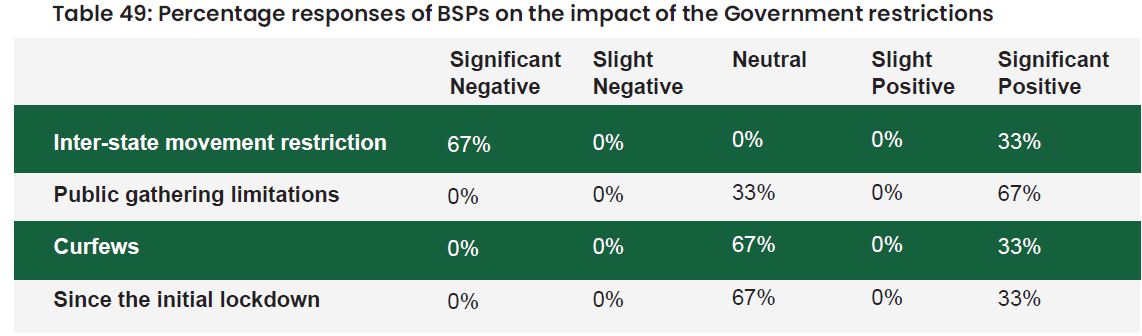

Impact on Business Service Providers

The activities of the business service providers were negatively impacted with two-third of the respondent experiencing a significant negative impact and one-third experiencing a significant positive impact. There was limited interaction and engagement with stakeholders like financial institutions and large buyers, cancellation of MSME upgrading activities already scheduled to hold physically, the unwillingness of some clients to pay for services due to poor turnover, and loss of clients. The breakdown of the responses about the different measures by the government are presented below:

The restriction in movement (lockdowns and curfews), and physical gathering provided an opportunity for all the interviewed (100%) BSPs to explore the use of virtual platforms for engagement with stakeholders. This reduced cost of reaching clients significantly.

For BSPs that were not so prepared or used to using virtual platforms, there were many challenges during the initial period. This resulted in the cancelation of some agreed activities like the Warri Business Linkages and Investment Forum by Dorbudee Integrated Consult (DIC) and other support to businesses due to the lockdowns and restriction on gathering.All the respondents collaborated with other BSPs in delivering some of their support during this period. The BSPs leveraged the technological skills of other BSPs to begin virtual engagement with clients while also networking among themselves to provide physical training for their clients in locations where they could not travel as a result of the inter-state lockdowns.

CAD Consulting Limited migrated/digitalized the Nigerian Agricultural Enterprise Curriculum (NAEC) training modules and the AGSMEIS training to an online format for easy delivery of the capacity building activities for MSMEs.

All the interviewed service providers used virtual platforms, emails, and phone calls for engagement with stakeholders and to provide support to enterprises.

CAD set up two professional studios in their office for quality virtual training delivery.

CAD Consulting Limited and ZAL Consulting (business service providers) saw more opportunities to leverage funds for enterprises through the programs initiated by Government like the CBN Agro-SME Investment Scheme (AGSMEIS), Covid-19 intervention fund, and Anchor Borrowers’ Scheme. For CAD, registration of businesses and (National Agency for Food and Drug Administration and Control (NAFDAC) certification became easier.

Dorbudee Integrated Consult (DIC) adhered to covid-19 protocols in delivering support to enterprises.