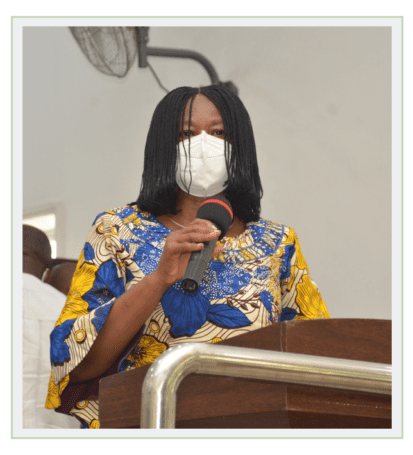

Irene Abidoye on the Impact of Peace Clubs in Secondary Schools in Ondo State

Irene Abidoye speaks on the impact of peace clubs in transforming the lives of secondary school students in OndoState. Become a peace actor in your community today and play your part!